DeFi "Safety"? More Like Rats Fleeing a Fire

The October Massacre: DeFi's Bleeding Continues

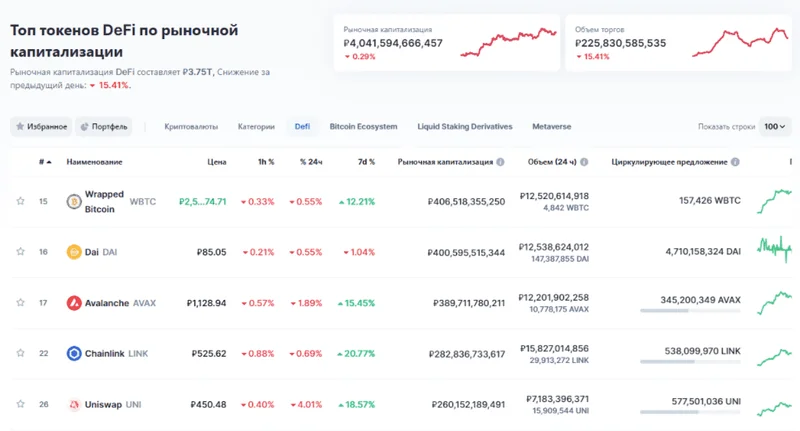

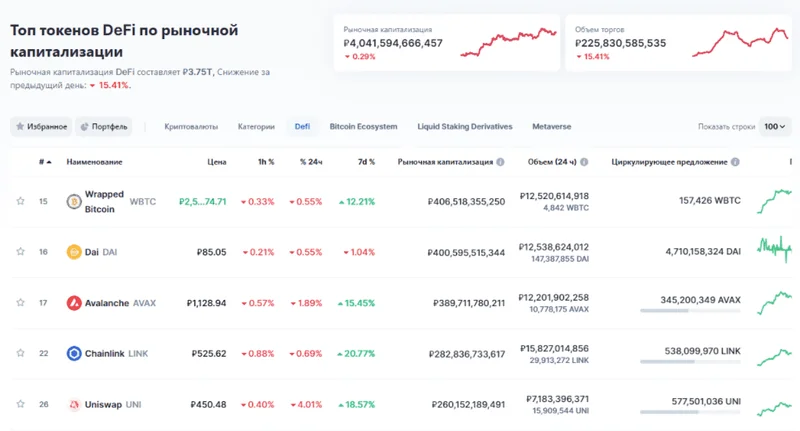

So, the "smart money" is flocking to "safer" DeFi tokens after the October 10th crash? Give me a break. FalconX is reporting that only *two* out of *twenty-three* leading DeFi tokens are positive YTD as of November 20th, 2025. Two. That's not a "flight to safety"; that’s rats fleeing a sinking ship, desperately clawing at anything that floats. According to a

DeFi Token Performance & Investor Trends Post-October Crash report, the market has seen significant investor shifts.

And what qualifies as "safe" in this clown show? Apparently, tokens with buybacks, like HYPE and CAKE, are the new black. Oh, and anything with an "idiosyncratic catalyst," whatever the hell *that* means. Minimal impact from the Stream finance collapse? Growth somewhere else? That's the best we've got? I’ve seen more compelling arguments scrawled on bathroom walls.

The whole thing feels like rearranging deck chairs on the Titanic. Sure, maybe you get a slightly better view as the iceberg rips through the hull, but you're still going down.

DeFi's "Winners": Just Losing Less Badly?

DEXs vs. Lending: Who's Losing Less Slowly?

Then there's this gem: some DeFi subsectors are "cheaper," while others are "more expensive." Spot and perpetual DEXes are supposedly getting cheaper because their prices are tanking faster than their activity. Okay, so they're losing value less slowly. Congratulations?

Lending and yield names, on the other hand, are "more expensive" because their prices haven't collapsed as much as their fees. So, people are piling into lending because they think it's "stickier" than trading in a downturn? That's like saying a leech is a better pet than a goldfish because it's harder to flush down the toilet.

I mean, what are we even doing here? Are we seriously patting ourselves on the back for finding the least-worst place to park our crypto while the whole damn market burns?

And this talk about "fintech integrations" driving growth in lending? Please. AAVE’s high-yield savings account? MORPHO's Coinbase integration? These are band-aids on a gaping wound. It's like trying to fix a broken leg with a cough drop.

Speaking of broken legs, I swear, my internet provider has been throttling my connection speed for weeks now. Coincidence? I think not. They’re probably in cahoots with the crypto crash, trying to make it harder for me to short these garbage tokens. Conspiracy? Maybe. Am I paranoid? Absolutely.

Spinning Disaster: "Opportunities" for Who, Exactly?

"Opportunities from Dislocations"? More Like Opportunities for Bagholders

The article ends with the obligatory "potential opportunities from dislocations." Translation: "We're trying to spin this dumpster fire as a buying opportunity for suckers." It will be interesting to see if the changes mark the beginning of a broader shift in DeFi valuations or if these will revert over time? Offcourse they won't.

Investors expect perps to continue to lead, and HYPE’s relative outperformance may point to investor optimism around its ‘perps on anything’ HIP-3 markets, which are seeing their highest volumes as of Nov 20. Yeah, right. According to

The Striking Dichotomy in DeFi Tokens Post 10, there is a clear divide in DeFi token performance.

The cheapening in the DEX sector may be warranted on lower growth expectations. No, it *is* warranted.

The only crypto trading category seeing record volumes lately are prediction markets. So, what, we're betting on when the whole thing collapses? Real smart.

I can't help but wonder if anyone in this space has a shred of self-awareness left. Are they so blinded by hopium and greed that they can't see the writing on the wall? Maybe I'm the crazy one here, but I'm starting to think the whole DeFi experiment was a colossal mistake.

The Emperor Has No Clothes